A new report from Florida Realtors revealed increased inventory and higher median prices across the state in February.

According to the report, single-family home sales increased 1.9 percent while condo-townhouse closed sales dropped 5.7 percent compared to the prior year.

“Homebuyers in Florida have grown accustomed to dealing with a shortage of for-sale inventory, especially when it comes to first-time buyers trying to enter the market,” said Eric Sain, president of Florida Realtors.

The numbers also revealed statewide median prices for both single-family homes and condo-townhouse properties increased.

Existing single-family homes were $250,000, up 1.3 percent. Condo-townhouse units were $187,500, up 4.7 percent.

This marks the 86th consecutive month that median prices for both condo-townhouse units and single-family homes have risen.

While median prices are up, Nationwide’s most recent Health of Housing Markets Report revealed that house price appreciation is actually slowing, which is boosting the outlook for housing sustainability.

The report forecasts positive or neutral outlooks for the 40 largest cities across the country, which includes Tampa, Miami, Orlando and Fort Lauderdale.

For those in Jacksonville, a recent survey from Credit Suisse noted “moderating rates and snowbirds coming down from Northern states drove demand above realtors’ expectations,” and real estate agents are expecting a surge of supply this spring.

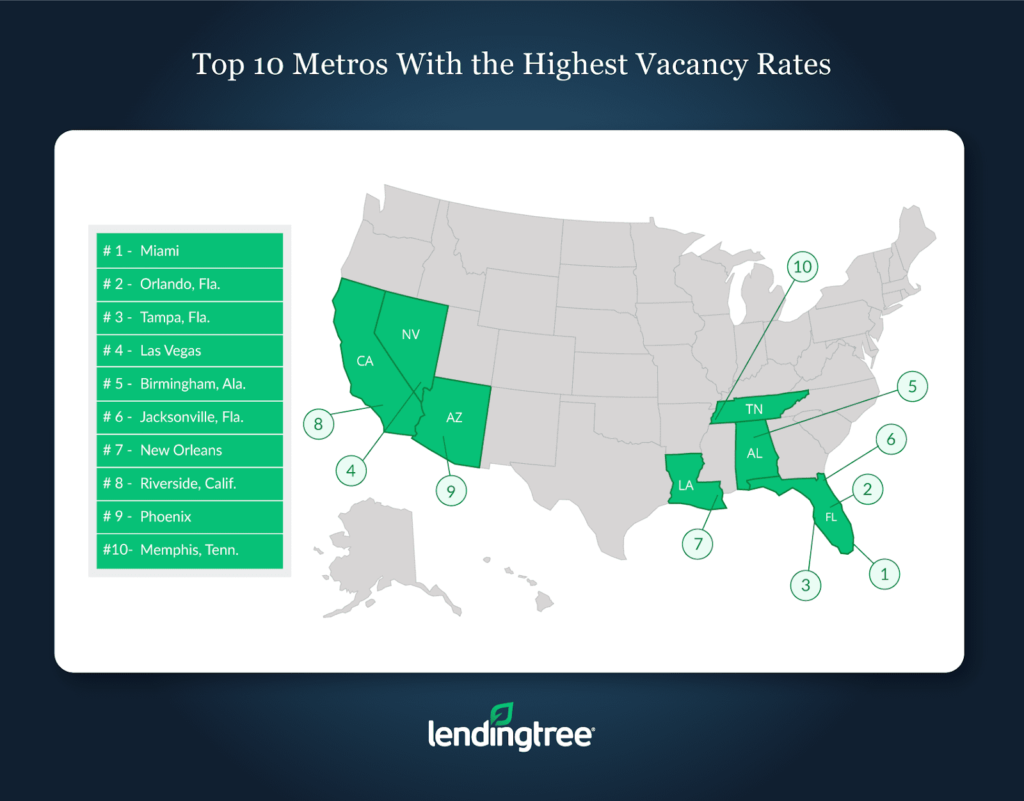

Miami, Orlando and Tampa and are one, two and three, respectively, when it comes to the highest vacancy rates around the United States, according to researchers at LendingTree. Jacksonville wasn’t far behind at number six.

“Knowing the number of vacant homes in an area is an important part of understanding the overall health of the local housing market,” said Tendayi Kapfidze, chief economist at LendingTree.

Kapfidze says knowing why a property is vacant can also help homebuyers determine if the price is right.

“For example, if both vacancy rates and home prices are relatively low, it could mean that sellers are parting with their homes for less money than they could have potentially gotten,” he said. “If vacancy rates are low and housing prices are high, it could signify that the market is overly competitive, and that lower-income people might have a problem finding a house.”

For Florida cities, a lot of it has to do with properties being second home getaways, which is something Kapfidze noted.

“One of the main reasons vacancy rates are so high in these areas is that Florida is a popular destination for homeowners to buy secondary residences,” he said. “These types of residences often remain unused throughout most of the year, with their owners only living in them during select times, like winter. This means they count as vacant in our data.”

While inventory and median prices are up across the state, so is the median time to contract for closed sales.

“Half of the single-family homes selling in February were on the market for at least 54 days before going under contract – this compared to a median of 48 days last year,” said Dr. Brad O’Connor, chief economist for Florida Realtors. “In the condo and townhouse category, there’s a similar trend: the median time to contract was 58 days, up from 51 days last year.”

Mike has more than 30 years of experience in marketing and public relations. He once owned his own agency and has worked with some of the largest brands in the world.