The founder of the Medical Marijuana Business Association of Florida (MMBAFL) says SunTrust has reached out to the organization after the bank closed their account.

“As an association, you know, we receive funds from a number of different entities. Physicians groups, non-profits. We’re not selling marijuana,” Dr. Jeffrey Sharkey told the Capitol News Service. “I think their real concern is with licensees who are actually dealing with the product, plants. So, we’ve had some preliminary conversations and I appreciate them reaching out.”

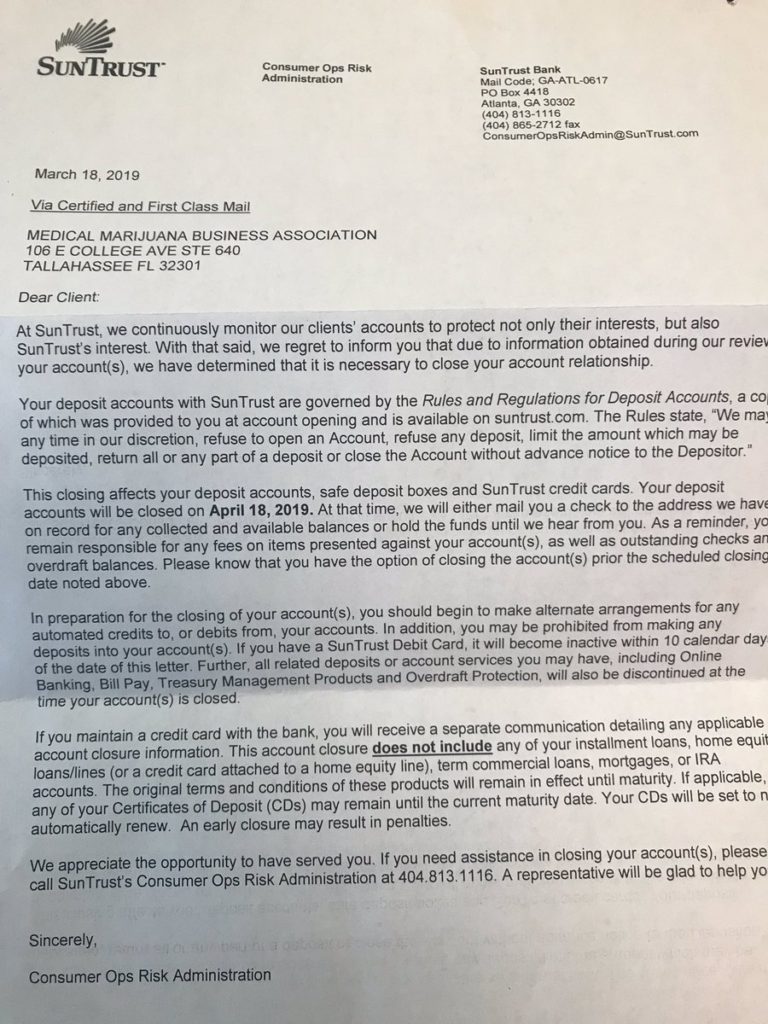

News of the cancellation came to light when the MMBAFL’s Twitter account posted the letter they received from SunTrust notifying them of the closure.

“Just received notice that @SunTrust is shutting down our bank account after 5 plus years. They are on the wrong side of #Florida voters for #MedicalMarijuana trying to stop us but we WON’T stop fighting for YOU: the Patients, the Industry #FlaPol #Sayfie,” the tweet read.

As it stands, SunTrust will be closing the MMBAFL’s accounts on April 16.

Florida Agriculture Commissioner Nikki Fried blasted the bank’s decision.

“As we move forward on cannabis with an expansion of access to medical marijuana and a state hemp program, SunTrust’s policy shift is a move in the wrong direction,” she said. “A lack of financial services forces all cash operations, which is inefficient and a public safety risk. Businesses can’t operate with irregularities restricting their growth, stability and ability to pay bills.”

Fried is all too familiar with the issue. While campaigning in 2018, Wells Fargo closed down her campaign accounts for supporting the legalization of medical marijuana and accepting donations from industry actors.

“As a result of a recent review of your account relationships, we determined that we need to discontinue our business relationship and close the account,” the company explained in a letter.

Marijuana remains a Schedule I drug under federal law, which is why established banking institutions continue to distance themselves from political leaders and organizations taking money from medical marijuana companies.

For a period of time, First Green Bank in Orlando was accepting cash from pot dispensaries. However, the Palm Beach Post reported that came to an end after Seacoast Banking Corp. acquired First Green.

Fried says banking institutions need to get with the times because of the benefits she believes the industry brings to the state.

“Cannabis provides an important medicine and an incredible economic potential for Florida. We should be enacting forward-thinking policies to position our state to become a national leader in the industry,” Fried said.

Even though the Medical Marijuana Business Association of Florida and SunTrust are in communications, the MMBAFL continues to look for another bank.

The Medical Marijuana Business Association of Florida was formed in 2014 “to protect and promote a rational and compassionate approach to Florida’s emerging medical marijuana regulatory framework, serve as a responsible business resource for policy makers, support and grow business opportunities for the emerging medical marijuana industry, all while committing to protect the rights and dignity of medical marijuana patients and their families.”

William is the Managing Editor at FloridaInsider.com. His years of experience in journalism, broadcasting and multimedia include roles as a Writer and Web Producer. He graduated from Florida International University with a Bachelor of Science and Communication.